Irs Hsa Family Limits 2024. The hsa adjustments for individuals jumped 7.8% for 2024 compared to the previous year and increased 7.1% for family contributions, representing a $300 and. Single plans $ 3,650 $ 3,850 $ 4,150:

The limit for families will be $8,300. Hsa contribution limit for self coverage:

In Addition, You’ll Also Need To Meet The Following.

The 2024 hsa contribution limit for families is $8,300, a 7.1% increase from the 2023 limit of $7,750.

Those 55 And Older Can.

Family plans $ 7,300 $ 7,750 $ 8,300 :

Single Plans $ 3,650 $ 3,850 $ 4,150:

Images References :

Source: simonnewblake.pages.dev

Source: simonnewblake.pages.dev

Irs Limits For 2024 Melva Sosanna, The hsa contribution limit for family coverage is $8,300. For hsa users aged 55 and older, you can contribute an extra $1,000 to your hsas.

Source: www.sequoia.com

Source: www.sequoia.com

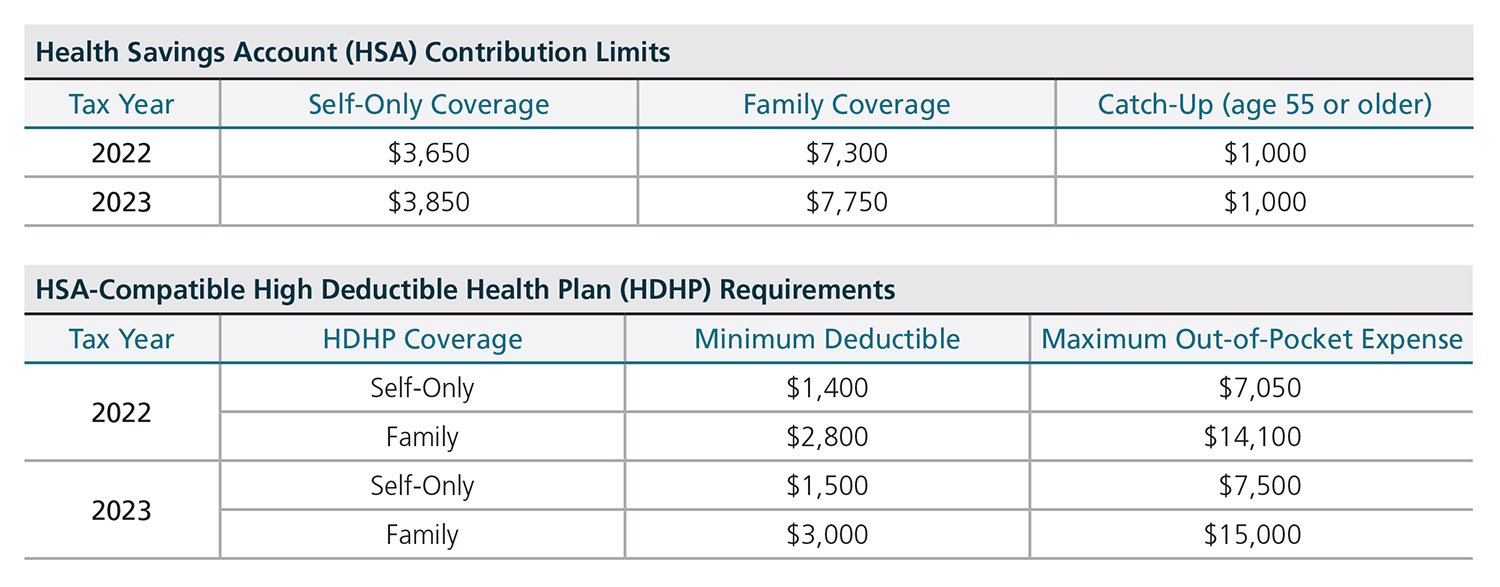

IRS Releases 2023 HSA & HDHP Limits Sequoia, $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from. The 2024 hsa contribution limit for families is $8,300, a 7.1% increase from the 2023 limit of $7,750.

Source: 2023gds.blogspot.com

Source: 2023gds.blogspot.com

Must Know Roth Ira Max Contribution 2023 Ideas 2023 GDS, Family plans $ 7,300 $ 7,750 $ 8,300 : (people 55 and older can stash away an.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Fsa Limit For 2022 2022 JWG, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. Increases to $4,150 in 2024, up $300 from 2023;

Source: simafinancialgroup.com

Source: simafinancialgroup.com

IRS Announces HSA Limits for 2019 SIMA Financial Group, That limit increases to $7,750 if you. The limit for families will be $8,300.

Source: andyqkerrill.pages.dev

Source: andyqkerrill.pages.dev

Fsa 2024 Contribution Limits Clara Demetra, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. In addition, you’ll also need to meet the following.

Source: blog.threadhcm.com

Source: blog.threadhcm.com

IRS Announces 2023 HSA Contribution Limits, Family plans $ 7,300 $ 7,750 $ 8,300 : Single plans $ 3,650 $ 3,850 $ 4,150:

Source: www.amwinsconnect.com

Source: www.amwinsconnect.com

IRS Announces 2024 Limits for HSAs and HDHPs, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The limit for families will be $8,300.

Source: myameriflex.com

Source: myameriflex.com

IRS Announces 2023 Contribution Limits for HSAs Ameriflex, Family plans $ 7,300 $ 7,750 $ 8,300 : For the 2023 tax year, you can contribute up to $3,850 to an hsa if you have an eligible hdhp and are the only one on it.

+1500px.jpg) Source: thelink.ascensus.com

Source: thelink.ascensus.com

2023 HSA Limits Released — Ascensus, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. Individuals can contribute up to $4,150 to their hsa accounts for 2024, and.

The Hsa Contribution Limit For Family Coverage Is $8,300.

$4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from.

In Addition, You’ll Also Need To Meet The Following.

Hsa contribution limit for self coverage: